Losing your home to a fire is one of the most devastating experiences imaginable. I know because I’ve been through it. My family and I faced the heartbreak, confusion, and overwhelming task of piecing our lives back together after a fire. But through that experience, I learned that with the right steps, resources, and a clear plan, recovery is not only possible but also an opportunity to create something new.

This guide is for anyone who has experienced the loss of a home to fire. Whether it’s a wildfire in Los Angeles or a house fire elsewhere, the road to recovery starts with understanding what to do next. From immediate actions to documenting losses, navigating insurance claims, and rebuilding your home, this roadmap will provide clarity and direction.

Step 1: Ensure Safety and Take Immediate Actions

Your first priority is ensuring the safety of you and your family. After you’ve evacuated and confirmed everyone is safe, take these steps:

1.Wait for Clearance: Do not return to your property until authorities have declared it safe.

2.Contact Your Insurance Provider:

•Notify them of the fire to start your claim.

•Request a copy of your declarations page to understand your coverage.

3.Secure Temporary Housing:

•If your policy includes Additional Living Expenses (ALE), track all costs for hotels, meals, and transportation.

•Seek help from organizations like the Red Cross for emergency assistance.

Step 2: Understand Your Insurance Policy

Insurance policies can be complex, but breaking them into modules can simplify the process. Each module often has a separate adjuster assigned to handle claims for that specific coverage.

Key Insurance Modules and Adjusters:

- Structural Coverage: Covers damage to the home’s physical structure.

- Adjuster: A structural adjuster evaluates damage and provides estimates for repairs or rebuilding.

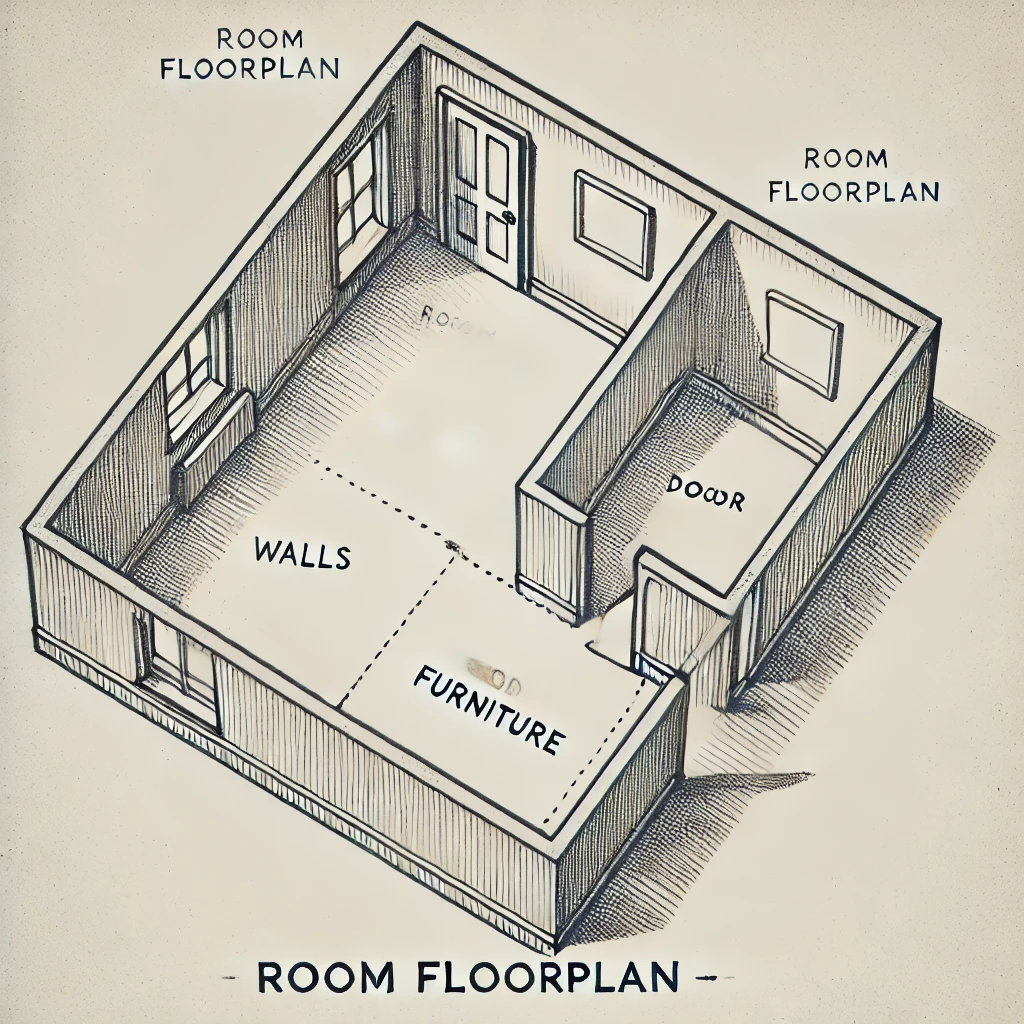

- •Documentation: Provide detailed photos, floor plans, and contractor estimates.

- Personal Property Coverage: Covers belongings like furniture, electronics, and clothing.

- Adjuster: A personal property adjuster will guide you in inventory creation and value assessment.

- Documentation: Use this Completed Home Inventory Spreadsheet as a reference or template to begin your inventory.

- Additional Living Expenses (ALE): Covers temporary housing, meals, and other costs incurred while your home is uninhabitable.

- Adjuster: An ALE adjuster reviews and approves living expense reimbursements.

- Documentation: Track receipts and expenses using Google Drive.

- Liability Coverage: Protects you if the fire causes damage to someone else’s property.

- Adjuster: May require additional legal documentation.

- For a more detailed explanation of these modules, visit NAPIA.

Step 3: Document Everything

Thorough documentation is essential for filing a successful claim. Be diligent knowing the first 3-months you might be spending more money than you though and cashflow is king, You want to stay ahead and remit your receipts – include your claim number in all correspondence.

- Take Photos and Videos: Use your smartphone to document all damage, inside and out.

- Use Google Drive to Organize Files:•Set up folders for receipts, warranties, and photos. Learn how with this guide.

- Create Floor Plans:•If you don’t have existing plans, check city records or online real estate listings.•Use the Room Template Floor Plan and Inventory Sheet to sketch layouts.

Step 4: Rebuild Your Home Inventory

Recreating your inventory may feel daunting, but these steps will make it manageable:

- Focus on One Room at a Time:•Sketch the room and note major furniture pieces to jog your memory.

- Collaborate with Family Members:•Share the task using this Room Template.3.Use a Sample Inventory as a Guide:•Reference this Completed Home Inventory Spreadsheet for ideas on structuring your list.

Step 5: Consider Hiring a Public Adjuster

Handling a complex insurance claim on your own can be overwhelming. A public adjuster is a professional who works on your behalf, not the insurance company’s, to ensure you get the compensation you deserve.

Why Work with a Public Adjuster?

- Expertise in Handling Complex Claims:•They understand policy details and ensure all modules (structural, personal property, ALE) are fully addressed.

- Maximizing Your Settlement:•Public adjusters know how to uncover overlooked damages and negotiate for the best settlement.

- Relieving Stress:•They handle documentation, communication, and negotiations, allowing you to focus on rebuilding.

- How to Find a Reputable Public Adjuster:•Verify licensing through your state’s Department of Insurance.•Use NAPIA to locate trusted professionals.•Clarify fee structures—typically 10–20% of the final settlement.

Step 6: Track Expenses and Stay Organized

Proper organization speeds up the claims process:

- Log Expenses: Use a Google Sheet to track temporary housing, food, and transportation costs.

- Scan Receipts: Scan them directly to Google Drive with your SmartPhone for easy sharing with your adjusters.

Step 7: Start Rebuilding – Finding Light at the End of the Tunnel

Rebuilding is an opportunity to turn a new page and create something better.

A modern two-story house featuring large floor-to-ceiling windows, surrounded by a landscaped garden with desert plants and a stream running through the property. The interior showcases an open-plan kitchen and living area with minimalist decor, smooth surfaces, and a view of the garden and stream. The outdoor space includes seating areas, emphasizing a seamless connection with nature.

- Dream Big: Create a wish list for your new home using this New Home Wish List Template.

- Envision Long-Term Needs: Consider energy-efficient upgrades, smarter layouts, and safety features.

- Collaborate and Visualize: Use Pinterest or Houzz to inspire design ideas for your new space.

Resources and Tools

Here are all the resources mentioned:

- Room Template Floor Plan and Inventory Sheet

- Completed Home Inventory Spreadsheet

- Setting Up and Sharing a Google Shared Drive

- Overview of Google Drive Features and Usage

- NAPIA: Find a public adjuster.

- New Home Wish List Template

Final Thoughts

Navigating life after a home fire is daunting, but with these steps, resources, and professional support, recovery is within reach. A public adjuster can be a trusted partner in maximizing your settlement, while the tools and templates provided here will keep you organized and empowered.

Remember, every step forward brings you closer to rebuilding not just your home, but your life.